A deep analysis of our Associate Alexander Gruzdev

What is happening in the Russian segment of the automotive business?

At StepsBridge, we support Ukraine and people of Ukraine and Russia. Not the current Russian government. This is a business only article, no politics, just facts, and analysis.

At the moment, most representative offices of automotive brands have suspended their business, both cars, and spare parts sales. Also, the majority announced the suspension of imports to Russia. In press releases, this is associated with the military operation in Ukraine. The media often called it a withdrawal from the Russian market. However, this is mostly not the case. The suspension of operations is not a withdrawal from the market, even a loudly replicated BMW statement about the closure of the business, is in fact, only a long (6 months) suspension of activity. The real reason is that both production and all sales in Russia rely on importing either cars, production components, or spare parts for aftersales.

At the same time, the dollar/euro/yen exchange rate is now incredibly volatile. You need to sell in Russia with rubles and buy somewhere else with foreign currency. Hence the big problem is the price to sell. It is far easier to wait until the situation settles down one way or another, and it will be possible to revise prices and resume work. It is easy to leave the market for such brands as Volvo or Jaguar, when Russian market sales represent just few hundred units per year and the overall share is less than 1%. However, for some other brands it could be much harder to decide to totally quit the market. For example, for Renault-Nissan-AvtoVaz it represents 8.6% of total sales of the alliance. Russian sales are 6.8% of worldwide sales for Kia, even Toyota, which has only 1.6% of worldwide sales, already announced to restart the office and replenish stock in the next few days.

Dependency on the imports from the EU

At the same time, all local automotive plants (BMW, Renault, Hyundai, Toyota, VW, etc.) are currently stopped due to a lack of components. Even the LADA plant has been stopped. Although the stop was planned before the current situation, nevertheless, the duration is already longer than initially expected. Lada is part of the Renault-Nissan alliance and the production of most models critically depends on the supply of components imported from the EU and other countries. So even for Lada import is critical. Currently, only the legendary Lada Niva could be produced without imported parts, all other models are linked to Renault models and rely on international suppliers of Renault.

What about the the manufacturers of spare parts?

Among the manufacturers of spare parts, there have not yet been official statements about leaving the market or anything similar. Still, almost all spare parts manufacturers have also suspended sales and deliveries. The reasons are the same as for car manufacturers; there is no understanding of prices. Many part manufacturers also depend on stocks outside of Russia as they import all the parts and don’t have local inventory. For such companies we can see the decision to leave the market, but some others have local production and plants, their own stock and a large number of employees. Such companies won’t be so quick to decide the future.

This has already led to a shortage of spare parts on the market, both OE and IAM. Distributors are selling their stocks, on average, with an additional mark up of about 30-35% (the dollar exchange rate has risen by 30% at the moment). Some distributors have their own private brands produced in China. They have declared only logistics issues but do not expect the effect to be strong. China did not impose any sanctions on Russia. There are direct railways from China to Russia, so sea logistics are not impossible to substitute.

On the other hand, buyers are trying to do all the maintenance and repair and even purchase spare parts for the next one, hoping they will get it before prices rise. This leads to an additional divergence of supply and demand.

Main conclusions

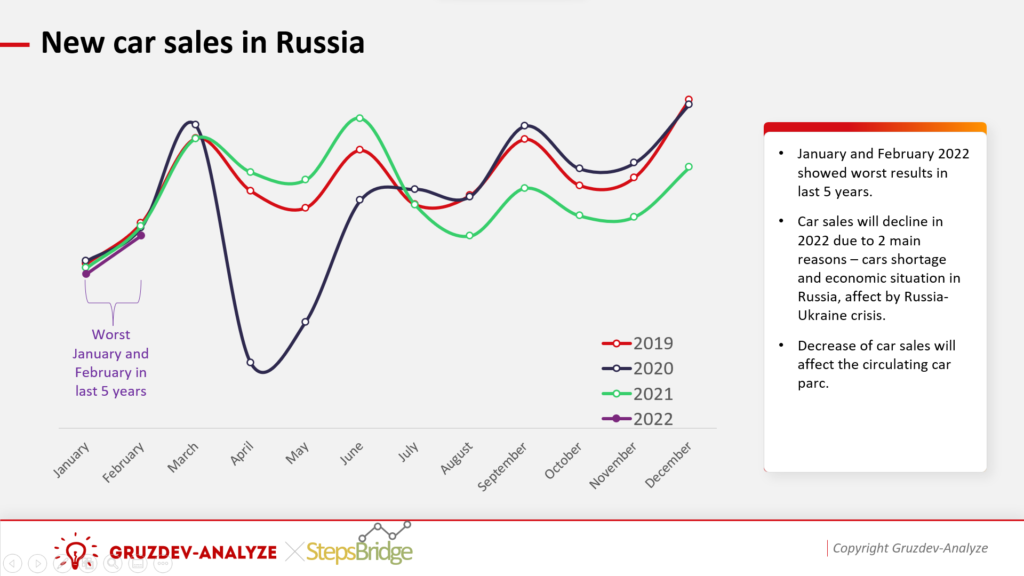

In the end, I would like to add that the Russian market of new cars has already been on the decline in recent years. With small fluctuations, the market was declining, and from the maximum values close to 3 million vehicles per year, it decreased two times to 1.5 million. January 2022 was the worst in the last five years; February 2022 also showed a 5% decline. March obviously will not show good results due to the Russia-Ukraine conflict. So there are no reasons to expect the car sales market to increase this year.

An exception to the new vehicle market is commercial and especially HD vehicles. Due to the fact that several major logistic companies refused to work with Russia (or on Russian territory), local companies will get additional business, so they will need more trucks and trailers, with Volvo and Scania deciding to leave the market, KAMAZ will win. Daimler declared to cancel its cooperation with KAMAZ. At the moment, there are several issues with components; however, there is no doubt it will be solved internally or with China’s help.

However, the after-sales market in Russia is much more stable; the circulating passenger car park exceeds 35 million cars. Moreover, fuel prices in Russia have not yet shown a severe increase. The sanctions on the air transportation market may even play into the hands of the automobile, increasing mileage. So those 35 million cars will be running and therefore need maintenance and repair.

About the Author: Alexander Gruzdev

International market intelligence expert with 20 years of experience, 15 in the automotive, aftersales, and mobility sector.

His range of customers covers from A (Audi) to Z (ZF) in 20 different countries in the world. Alex is an active Conference Automotive Expert speaker, media contributor and has over 200 publications in professional magazines, regular TV and radio.